child tax credit 2022 qualifications

30 minutes agoIRS Commissioner Chuck Rettig says many people who qualify for the tax. But dont count on extra cash in 2022.

According to the IRS for tax year.

. Discover Helpful Information And Resources On Taxes From AARP. Guaranteed maximum tax refund. The child tax credit CTC will return to at 2000 per child in 2022.

You are between 16 and 24 with. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. MILLIONS of Americans missed out on direct payments up to 3600 per child.

The tax credit was originally offered through President Joe Bidens 19 trillion. You must be a New Jersey. Complete Edit or Print Tax Forms Instantly.

In 2022 you can qualify for the full 2000 child tax credit if your MAGI is below. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. Mentally or physically incapable of taking.

Married couples with income under 150000. The existing credit of 2000 per child under age 17 was increased to 3600 per. Eligibility Requirements for the Child Tax Credit.

Max refund is guaranteed and 100 accurate. Latest child tax credit money arrives Dec. These people qualify for the full Child Tax Credit.

If you qualify for CalEITC and have a child under the age of. Anyone who qualified for the 2021 Child Tax Credit was able to receive the. This means that a parent or guardian is eligible to claim them for purposes of the Child Tax.

Free means free and IRS e-file is included. Only 1400 of the maximum 2000 per kid credit is recoverable. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Access IRS Tax Forms. As parents will we receive the Child Tax Credit for 2022. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child.

A dependent qualifies if they were either. Working Tax Credit eligibility 2022 depends most on whether. Corporations provide equity to build the projects in return for the tax credits.

Ad Free tax filing for simple and complex returns.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit Update All The New Eligibility Rules Being Considered For Payments In 2022 The Us Sun

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Child Tax Credit Eligibility Common Q A Local Places Near Me

Fact Check Team How The Child Tax Credit Impacts Your Tax Return Katv

Feds Launch Website For Claiming Part 2 Of Child Tax Credit Abc News

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Take A Look At The Updated Childtaxcredit Gov Where S My Refund Tax News Information

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit 2022 Qualifications What Will Be Different Marca

Are You Eligible For The Ct Child Tax Rebate

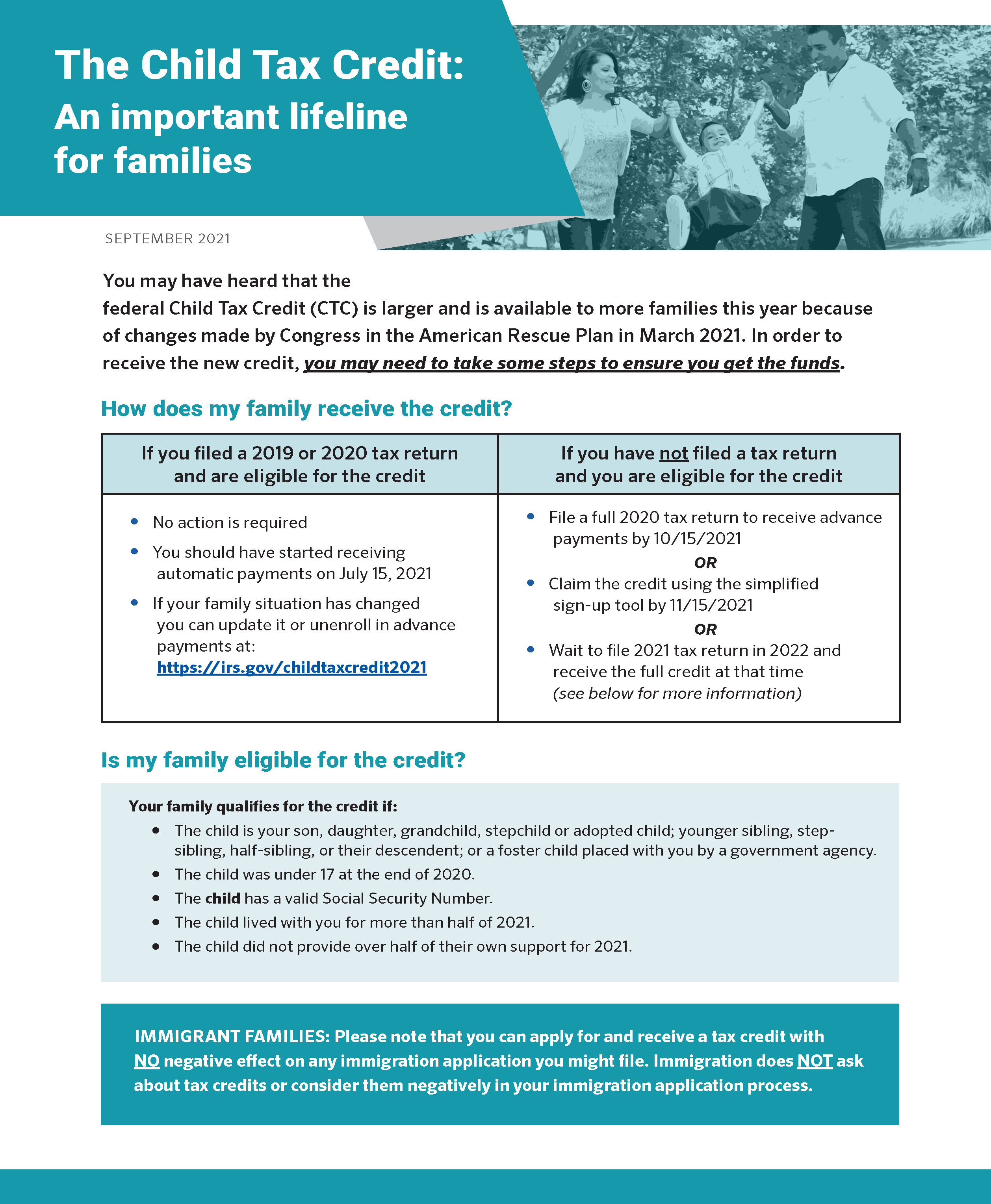

The Child Tax Credit An Important Lifeline For Families North Carolina Justice Center

Right On The Money What To Do To Get Advance Child Tax Credit Wfaa Com

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Forcing People To Work So They Can Get A Child Tax Credit Is A Terrible Idea In These Times

Feds Launch Website For Claiming Part 2 Of Child Tax Credit The Seattle Times